Key Takeaways

- Alarm.com shows solid financial health but is navigating a dynamic smart security market.

- Its core software-as-a-service (SaaS) revenue continues to grow, though some factors might temper overall expansion.

- Future growth is pinned on new ventures in commercial sectors, AI-driven video, energy management, and international markets.

- Significant challenges include rising competition from do-it-yourself (DIY) security systems and its important relationship with ADT.

- Key opportunities lie in expanding its video solution offerings and further integrating artificial intelligence.

Alarm.com Holdings, Inc., a prominent provider of cloud-based smart home and business security services, finds itself at an important crossroads. The company is adapting to a shifting competitive field and changing market demands.

Financially, Alarm.com appears robust. Analysis from Investing.com suggests the company has strong fundamentals, with liquid assets comfortably covering short-term debts and a moderate overall debt level, positioning it well for the future.

The company has consistently grown its SaaS revenue, a critical performance indicator. Over the last twelve months, revenue hit $955.37 million, a 6.72% increase. The first quarter of 2025 saw SaaS revenue and earnings beat expectations, partly thanks to its EnergyHub division.

With an impressive gross profit margin of nearly 66% and strong earnings before interest, taxes, depreciation, and amortization (EBITDA), the company demonstrates efficient operations. Analysts predict a 7% rise in SaaS revenue for fiscal year 2025.

However, Alarm.com isn’t without its challenges. Analysts expect a slight dip in revenue growth for fiscal year 2025. This is partly due to adjustments related to its partner ADT and how intellectual property license revenue is counted, leading to a more cautious SaaS and license revenue growth forecast of around 6.5%.

Alarm.com holds a strong position in the North American residential market, which has been its backbone. The company is actively looking to diversify by growing its business in commercial areas, enhancing video and AI capabilities, boosting energy management solutions, and expanding internationally.

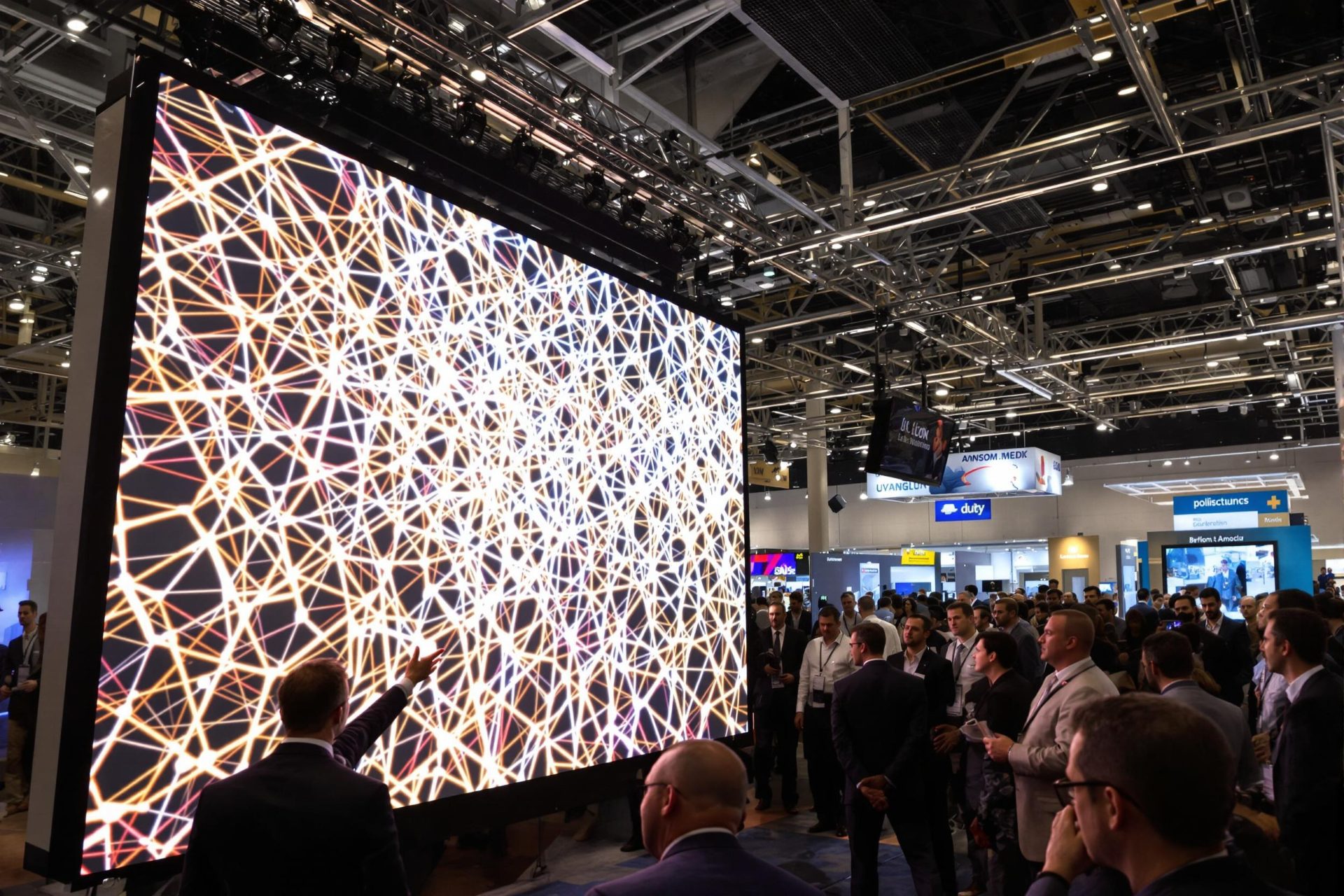

These newer ventures, like EnergyHub, are expected to be the primary drivers of future revenue. This strategy aims to balance any slowdowns in more established parts of its business. A focus on cutting-edge AI-powered video monitoring, showcased at its annual conference, could give it an edge.

One of the main hurdles is its relationship with ADT, a major source of revenue. Changes like ADT customer migrations and new ADT products developed with Google could create headwinds. Competition from DIY home security options offered by tech giants like Amazon and Alphabet also poses a threat to market share.

Despite these pressures, Alarm.com sees clear paths for growth. There’s a big opportunity to sell more video solutions to its existing customer base. Pushing into commercial properties and international markets could also unlock new income streams and lessen reliance on the North American home market.

The smart security industry continues to evolve quickly, driven by tech advances. AI and machine learning are becoming vital, and Alarm.com is positioning itself to lead in this area. Energy management solutions are also gaining popularity, aligning well with Alarm.com’s offerings and potentially driving significant growth.

The competitive scene is intense. However, Alarm.com’s strategy of partnering with over 12,000 service providers offers a unique way to reach customers, possibly shielding it from some direct DIY competition.

Potential downsides for Alarm.com revolve around how increased competition might affect its market standing. As tech giants push their DIY solutions, and if consumers increasingly opt for self-installation, Alarm.com could face pricing pressure and a smaller slice of the market.

The company’s ties to ADT, which accounts for a significant chunk of its revenue, also present risks. If ADT reduces its reliance on Alarm.com or customer transitions happen faster than expected, it could impact Alarm.com’s earnings.

On the upside, Alarm.com’s push into new markets like commercial and international sectors holds considerable promise. These areas could offer higher revenue per user and access to less saturated markets, diversifying income. Its EnergyHub division also taps into the growing global focus on energy efficiency.

Furthermore, the company’s investment in AI for video monitoring could be transformative. Advanced AI features might significantly boost the appeal of its security systems, potentially justifying higher prices and improving operational efficiency for customers.

A summary of Alarm.com’s position, as detailed by Investing.com, highlights strengths like strong SaaS revenue and a wide partner network. Key weaknesses include its dependence on ADT. Opportunities are seen in new market expansion and AI, while threats largely stem from intense DIY competition and potential shifts in the ADT relationship.

Various financial analysts have provided outlooks on Alarm.com’s stock, with firms like Barclays and Goldman Sachs setting price targets. These targets mostly hovered in the $60s for late 2024 and into 2025, based on the information provided by the source.